ADA Price Prediction: Technical Setup and Market Drivers Analysis

#ADA

- Current technical setup shows ADA trading below 20-day MA but with positive MACD momentum

- Bollinger Band positioning indicates potential for volatility breakout in either direction

- Fundamental developments including Leios upgrade provide long-term growth catalysts

ADA Price Prediction

ADA Technical Analysis: Key Levels and Momentum Indicators

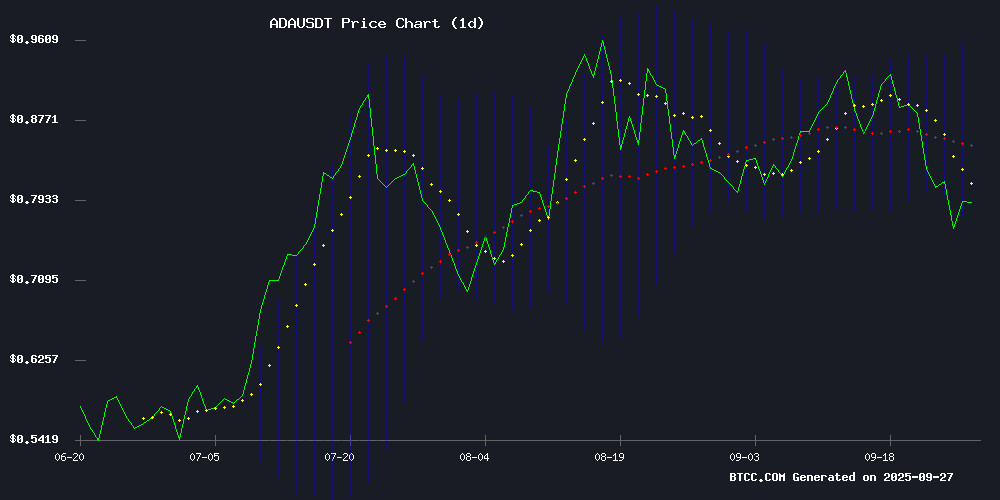

According to BTCC financial analyst Sophia, ADA is currently trading at $0.7824, below its 20-day moving average of $0.8638, indicating short-term bearish pressure. The MACD shows positive momentum with the histogram at 0.0332, suggesting potential upward movement. However, ADA faces resistance at the Bollinger Band upper limit of $0.9604, while finding support at the lower band of $0.7671. The current position NEAR the lower Bollinger Band may indicate an oversold condition.

Market Sentiment: ADA at Critical Juncture Amid Ecosystem Developments

BTCC financial analyst Sophia notes that while Cardano faces short-term challenges in breaking the $1 psychological barrier, the ongoing Leios upgrade implementation provides fundamental support for long-term growth. The market sentiment appears cautiously optimistic as traders balance volatility concerns with ecosystem expansion prospects. The phased rollout of throughput improvements could gradually strengthen ADA's competitive positioning among emerging protocols.

Factors Influencing ADA's Price

Cardano's Struggle for $1 as Traders Shift Focus to Emerging Protocols

Cardano's ADA, once a darling of the smart contract arena, faces mounting skepticism as its price fails to breach the $1 barrier. Futures activity has dwindled by 23% since mid-September, with the $0.76 support level teetering and repeated attempts to reclaim $0.84 falling short. The fading momentum raises questions about ADA's near-term prospects.

Meanwhile, protocols like Paydax Protocol are gaining attention by prioritizing utility over speculation. Paydax ties its token's value to tangible engagement metrics, offering a contrast to ADA's reliance on market sentiment. As Cardano grapples with slow adoption, the market's appetite shifts toward projects delivering measurable functionality—regardless of broader crypto volatility.

Cardano Price Prediction: ADA at Crossroads Amid Volatility and Ecosystem Growth

Cardano's ADA token faces a pivotal moment as conflicting technical and fundamental forces drive market uncertainty. Trading near $0.78 with a 3.7% daily decline, the digital asset shows heightened volatility—dipping to $0.76 before partial recovery. Market capitalization holds at $28.4 billion despite the pullback, supported by $2.1 billion in daily trading volume.

Technical indicators reveal ADA hovering above critical $0.78 support, with resistance looming at $0.82-$0.85. A breakdown below $0.75 could trigger a test of $0.70 support. Meanwhile, Cardano's development team continues advancing ecosystem upgrades, creating a divergence between price action and network fundamentals.

Cardano's Leios Upgrade Set to Boost Throughput with Phased Rollout

Sebastian Nagel, lead architect for Cardano's Leios project, confirmed an August release for the Leios CIP-164 upgrade. The phased implementation begins with Leios Lite, targeting a 30-55x increase in transaction throughput. Input Output Global's summer research culminated in this protocol enhancement, now formally integrated into Cardano's roadmap.

The staged deployment serves as a stress-testing mechanism. Leios Lite will provide real-world performance data before full implementation. "This approach allows for iterative refinement," Nagel noted, emphasizing the importance of stability before scaling. Charles Hoskinson has publicly reaffirmed Leios' strategic role in Cardano's development pipeline.

How High Will ADA Price Go?

Based on current technical indicators and market developments, BTCC financial analyst Sophia projects that ADA could test the $0.96 resistance level in the near term if bullish momentum sustains. The successful implementation of the Leios upgrade and broader market recovery could potentially push ADA toward the $1.20-$1.50 range over the next 3-6 months.

| Timeframe | Price Target | Key Drivers |

|---|---|---|

| Short-term (1 month) | $0.96-$1.05 | MACD momentum, Bollinger Band squeeze |

| Medium-term (3-6 months) | $1.20-$1.50 | Leios upgrade completion, ecosystem growth |

| Resistance Levels | $0.96, $1.10, $1.25 | Technical barriers and psychological levels |